putnam county property tax bill

A property tax calculator is available to estimate the property tax due for any appraised value. Putnam Country Tax Assessors Office Website.

Putnam County Property Tax Inquiry

The Town of Putnam uses Invoice Cloud for anyone choosing to pay their real estate business personal property or motor vehicle tax payments with credit card debit card savings account.

. This can be found on your tax bill that was mailed to you from the Putnam. 2021 Putnam County Budget Order AMENDED - Issued February 12. The Putnam County Commission sets.

100 South Jefferson Avenue Suite 207 Eatonton GA 31024 706-485-5441 Fax 706-485-2527 Pamela K. The accuracy of the information provided on this website is not guaranteed for legal purposes. Other duties of this office include issuing titles.

Who sets the county tax rate and when. Real estate bills will still be sent to show total deductions. OFFICE OF REAL PROPERTY 40 Gleneida Ave.

The 2022 City of Cookeville Property Tax Rate is 082 per 100 of assessed value. Any tax payer wishing. Exemptions and deductions are available in State of Indiana which may lower the propertys tax bill.

Official Putnam County Illinois website features interactive maps for economic development government minutes agendas county departments. House Number Low House Number High. What is the Putnam County tax rate.

Credit card payments will be accepted at the. Instead contact this office by phone or in writing. Residents can pay andor view.

Putnam County Sheriffs Tax Office 236 Courthouse Drive Suite 8 Winfield WV 25213 304 586-0204. GOV PAY click here. Putnam County Sheriffs Tax Office 236 Courthouse Drive Suite 8 Winfield WV 25213 304 586-0204.

In-depth Putnam County IN Property Tax Information. Putnam County Property Tax Facts. Online Property Tax Payment Enter a search argument and select the search.

2022 Putnam County Budget Order - Issued January 5 2022. Taxes must be paid by. These are deducted from.

Taxes may be paid by credit card or electronic check at. To search for pay or print copies of tax bills please visit the Tax Commissioners. Welcome to the County of Putnam Online Property Tax System Pay property taxes due to the Commissioner of Finance online by E-Check or by Credit Card.

Unpaid tangible personal property accounts begin accruing interest at a rate of 1 ½ per month. The Putnam County Tax Commissioner should be contacted with tax bill related questions at 706-485-5441. 3 penalty and advertising fee applies to unpaid real property taxes.

Understanding Your Tax Bill - Click to Expand. The 2022 county tax rate is 2472 10000 2472 assessed value. Changes occur daily to the content.

Each November 1st the Tax Collector opens the tax rolls and mails tax bills to the owner of record from the beginning of the calendar year. Putnam County Property Tax Inquiry.

Real Property Tax Service Agency Putnam County Online

Proposed Property Tax Amendment Could Jeopardize Local Excess And Bond Levies West Virginia Center On Budget Policy

Hecht Group Payment Methods For Putnam County Property Taxes

Property Appraiser Putnam County Florida

Putnam County Tax Assessor S Office

Putnam County To Send Out Revised Tax Bills

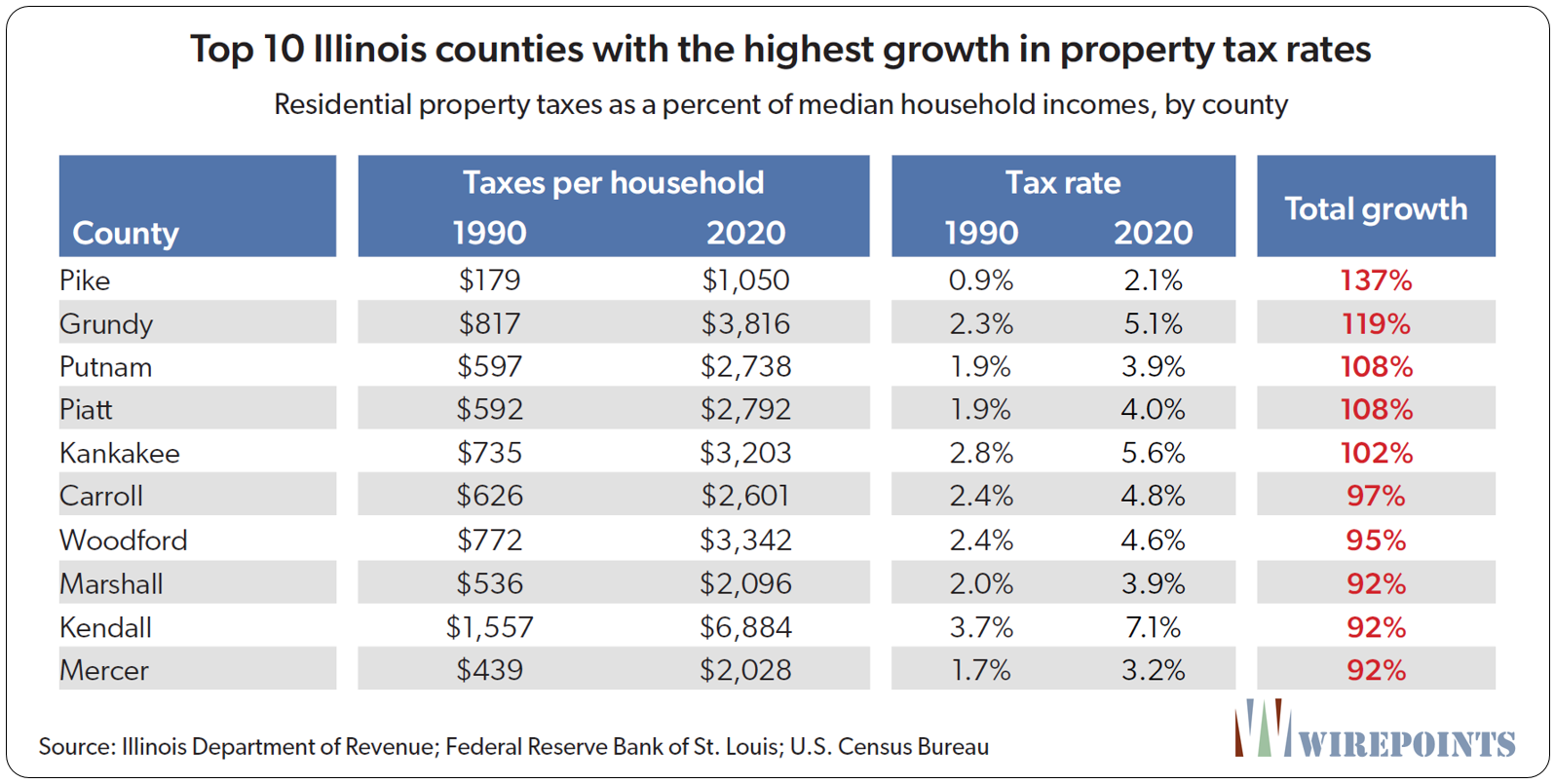

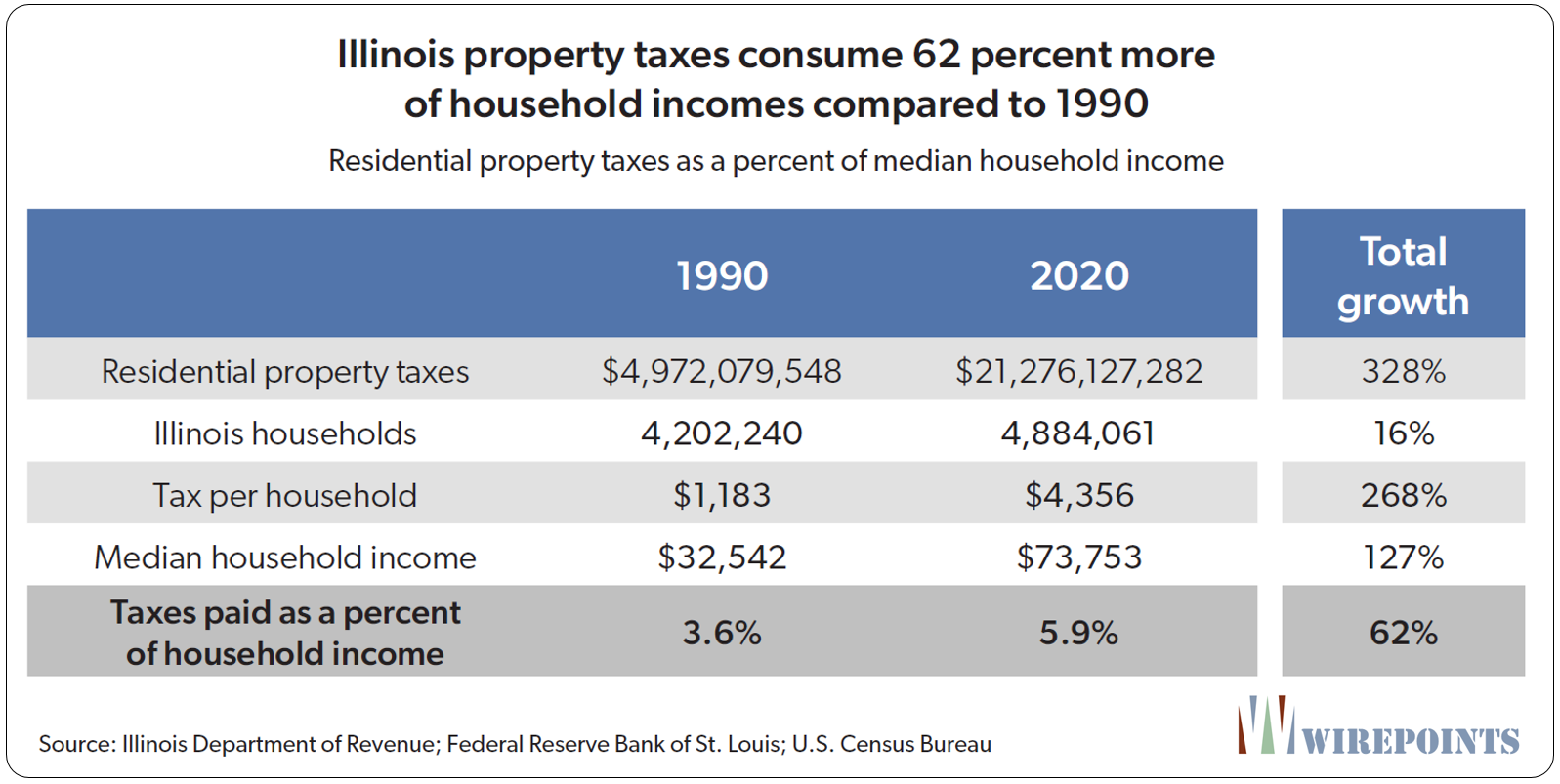

Thirty Years Of Pain Illinoisans Suffer As Property Tax Bills Grow Far Faster Than Household Incomes Home Values Madison St Clair Record

Property Tax Bills Have Been Mailed Out Polk County Tax Collector

Sample Property Tax Bill Polk County Tax Collector

Tax Division Putnam County Sheriff

Putnam County Tax Assessor S Office

Large Parcel Of Land In Putnam County Sold Jacksonville Business Journal

Tax Collector Property Appraiser

Suffolk County Ny Property Tax Search And Records Propertyshark

Thirty Years Of Pain Illinoisans Suffer As Property Tax Bills Grow Far Faster Than Household Incomes Home Values Madison St Clair Record